manufactured homes. They are approximately 2” x 4”, red, and have ID numbers stamped into them. They should NEVER be removed or painted over or hidden.

During an appraisal of a manufactured home, the appraiser must take pictures of each of the HUD plates and verify that they match the Certification Label. They will also look to make sure that the plates are sequential. If the plates are

missing, new plates will have to be issued or a “Letter of Label Verification” has to be issued. This can take weeks unless you pay for a rush. To obtain this letter, the current owners have to call the Institute of Building Technology and Safety at 703-481-2010 or their web site link is here: Building Technology and Safety.

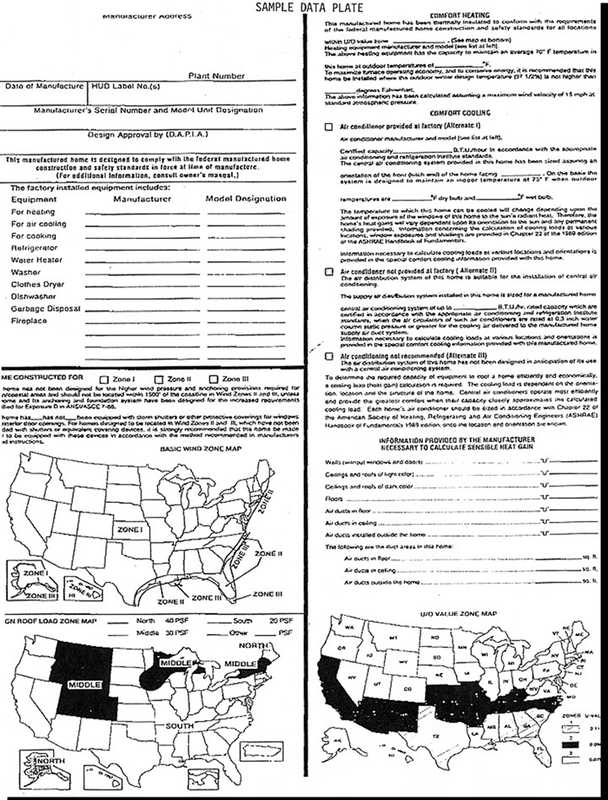

The 2nd item is the Certification Label or Data Plate, this is typically located under the kitchen sink, on the right side of the cabinet, in the electrical panel, or in bed room closet. Here is various information about the home, including HUD Plate ID numbers, serial numbers, wind zone, snow load, and manufacturing information. The appraiser will also need to take a picture of this document as well.

Again, if the Data Plate is not accessible, missing, or painted over, or trashed, then the owner needs to again call the Institute of Building Technology and Safety to request a new one.

Safety and Security

If the home is on a well and septic system, these will have to be inspected also. A third party, independent inspection of the Septic along with pumping will have to be completed, unless the current owner can produce documents that a septic pump and inspection has been completed within the last 365 days.

Well inspection will also have to be obtained, no matter how recent it was completed. The water needs to be drawn by an independent 3rd party (Realtors, Buyers and Sellers are NOT allowed to take water samples) and sent to a HUD certified lab.

If the home is on city services, no inspection will be needed.

Distance is also a concern for wells and septics, a Well Head must be a minimum of 50 feet from the Septic Tank & Leech Lines.

Manufactured homes in Idaho, are a popular way of getting into a home at very low costs. They are built to current building standards and when properly installed and maintained, will last as long as a typical constructed home. But when a person is purchasing and existing one, it is important to look for items, such as HUD Plates, to ensure a smooth transaction. And we always recommend that you get a independent 3rd party home inspection.

Prior to purchasing a home, we also recommend that you complete a quick check list of items which government appraisers look for, a link to that list is here. And if you are a home owner, and are going to sell, we also recommend that you too review this check list. This way you can avoid any surprises from a home inspector or an appraiser. Link to Check List Here

1st Choice Mortgage, located in Meridian, Idaho, has many options for people purchasing or refinancing Manufactured homes and are very experienced in overcoming hiccups along the way. Give us a call today!

Learn more about Manufactured Home Mortgage Loans